How to get a loan in Sweden

Loans today are one of the de facto methods of acquiring money for purchases. Gone are the days when applying for a loan seemed tedious. With the swift execution of services and hundreds of financial institutions at your disposal, getting loans has become more accessible.

Most of the time it is seen people use an unsecured personal loan to pay off a debtor secure large purchases. Although applying for a loan is much smooth nowadays, there are several things to keep in mind. Let us discuss what all shall ex-pats have when applying for loans in Sweden.

Fast loans in Sweden

Loan calculator

So, what are the best loan providers in Sweden and which of them offers the best terms and conditions? We have listed below the most frequently used providers in Sweden.

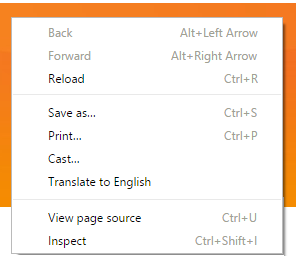

If you land on the website of an loan provider company (which is often in Swedish), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of an loan provider company (which is often in Swedish), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

Be aware that Borrowing money costs money

| Borrowing Range | Interest | Payment Period | |

|---|---|---|---|

| Lendo.se | 10.000 – 600.000 kr | 2,95 – 29,95 % | 12 – 180 mths |

| Enklare.se | 5.000 – 600.000 kr | 2,95 – 5,95 % | 12- 240 mths |

| Banknorwegian.se | 5.000 – 600.000 kr | 4,99 – 22,99 % | 12 – 180 mths |

| Lendify.se | 20.000 – 500.000 kr | 2,95 – 17 % | 12 – 180 mths |

Why opt for a loan in Sweden?

Sweden is a wonderful place to live. However, handling the expenses of living here may sometimes need to take a loan to get everything covered swiftly. Here are some reasons why you can also consider taking a loan in Sweden.

- When you buy an apartment or rebuild or reconstruct your existing home in Sweden, you can opt for a loan.

- You can get your hands on a car loan while buying or leasing a car, whether it is a new one or a used one.

- When you buy big things, like an electronic device, some big household essentials, etc.

- Getting a loan is a great option for debt consolidation.

- You can also take a loan for covering the expenses of moving from one place to other.

- These were some reasons to opt for a loan in Sweden instead of investing your own money. It is indeed a smart choice.

Personal loans explained

What is a personal loan?

We all know that loans are one of the most effective ways of getting financial help. But to find which loan is best for you, it is better to know about the different types of loans first.

Personal loan

A personal loan is a type of unsecured loan that the borrower repays in monthly installments. These types of loans are not backed by collateral and are usually taken to cover personal expenses.

Most of the time, when you apply for a personal loan, the financial institutions such as banks and lenders are seen considering factors, such as credit score, credit report, and debt to income ratio.

What is the expected rate of interest for a personal loan?

As discussed earlier, the interest rate for a personal loan is directly dependent on the credit score. If a borrower has a score of 690 and above, he/she is entitled to the lowest rates and higher amounts. On the other hand, people with high credit scores will have to pay a more significant interest rate.

What are the points to remember while applying for a personal loan?

- Check your credit score beforehand.

- Compare the options like interest rate and the overall time.

- Find a co-signer while applying for a personal loan.

- Consider a secured loan.

- Access the overall financial health to settle the debt easily.

How has corona virus impacted personal loans?

The corona virus crisis has thrust moneylenders into a significant crisis. While some have introduced small-dollar loans to people dealing with financial loss, other lenders have become strict with the requirements. However, other people are allowing to defer loan payments for a specified time.

What are the points to remember while applying for a personal loan?

There are many reasons for getting a personal loan, some of which are mentioned below:

- Debt consolidation for paying off the debt

- Using the loan amount to cover personal expenses

- For covering significant expenses like weddings, etc

How to Pick The Best Personal Loan?

The best way to compare personal loans is by checking out the rates offered by multiple lenders. The loan with the lowest APR is the least expensive and the best choice. If you have a good credit score and a healthy relationship with the bank, it is worth checking out the options available there. In this way, you can secure the best personal loan for yourself.

What are the different type of loans?

1. Car Loan:

A car loan is a secured type of loan used for buying a car. Although it can be taken under the category of personal loan, there is one significant parameter to remember. If, by any chance, one is unable to pay off the debts of a car loan then, the vehicle will be confiscated.

1. Car Loan:

A car loan is a secured type of loan used for buying a car. Although it can be taken under the category of personal loan, there is one significant parameter to remember. If, by any chance, one is unable to pay off the debts of a car loan then, the vehicle will be confiscated.

2. Home Loan:

A home loan is an amount that is borrowed from banks when buying a home. The home loans are further divided into four categories which are home purchase loans, construction home loans, land purchase loans, and home repair loans.

3. Student Loan:

A student loan is money borrowed from a financial institution for paying the college fees, books, tuition, room, and other expenses.

Advantages of online loans in Sweden

The online lending market has many people offering a wide range of loan types to people who want quick cash, whether for hospital bills, vacation, home renovation, or any other personal use. Let us guide you through the benefits of an online loan.

- Easy Applying Process: The process and application are easy and completely online for the online loan. Since the process is online, you can apply from the comfort of your house. All you need to do is download the app, make the account, and upload the needed documents, and your loan will get approved within a day.

- Quick Process: traditional loaning can take roughly at least a few days. Sometimes, the loan approval may stretch to over a month, and you will have to visit your bank several times throughout the month. The loan process will get approved for an online loan, and the amount will be sanctioned within 24 hours.

FAQ about loans in Sweden

A personal loan is simply the amount of money borrowed from a bank to pay off a personal expense. This type of loan is repaid in fixed monthly installments. Usually, if your credit score is good, the bank charges a low rate of interest for the amount.

Payments on the loans are usually calculated by considering the overall amount you have to borrow. Some lenders or financial institutes also check the APR (Annual Percentage Rate) before giving the sum in a fixed monthly payment.

A loan calculator is a virtual device that calculates monthly installments for you. All you have to do is enter the principal amount, rate of interest, and the total number of years; it will give the exact amount to be paid over the years monthly.